Pre-Paid Vouchers

If a group of people want to build something, but they don’t have enough money for it, the most common solutions are: Going into debt, or setting up a company and give away part of its equity.

Similarly, most people who buy a house, will take up a mortgage that they will have to pay off over a long time.

Instead of taking up a loan, a community interested in building local infrastructure could issue vouchers for future produce or services, selling them at a discount to attract customers.

This can happen in a two-stage process if risk is involved - for example, if there is a possibility that the infrastructure, say a wind turbine, won’t be built.

At the start of the project, potential buyers (who would buy vouchers near the completion of the project) are asked to register their interest. Seeing the numbers of those interested, specialist energy investors can then decide whether to buy vouchers, to sell them on to local buyers when the project nears completion.

Island Power are helping set up renewable energy systems on islands, from the Pacific to the Channel Islands, using energy-credit obligations (ECOs).

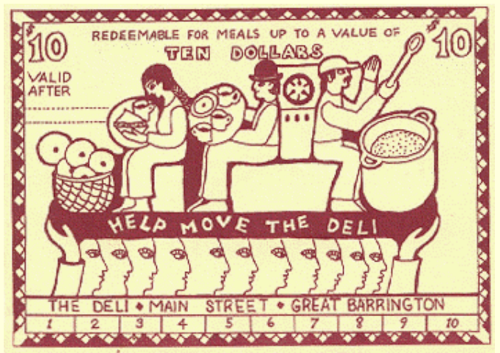

A famous, smaller-scale, example from the past is a deli in Massachusetts whose owner wanted to move to bigger premises, but could not get a loan he needed. He issued “deli dollars” for $8 that buyers could, at phased periods, redeem for $10 worth of food. He raised the necessary funds within a month.

‘Deli dollars’ issued by Frank Tortoriello in Great Barrington, Massachusetts in 1989, with great success

Pre-paid vouchers are an interesting form of savings, because they’re not denominated in national currency, but in useful things, like energy, food, rent for housing or office space, haulage, or any product or service.

Energy-credit obligations are denominated in kWh, for example. This means that this kind of saving is inflation-proof, because a kWh now is the same as a kWh in 10 years’ time. The UCO will be good for the kilowatt-hours specified, any time in the future, whatever happens to the price of electricity.

Use-Credit Obligations is the concept behind the pre-paid vouchers we use in our projects.